Over centuries, our perception of money and value has seen many transformations, influenced by technological advancements and societal changes. For example, the internet and digital technology have made financial transactions more accessible, increasing the volume and ease of paying and receiving funds. As a result, new payment ecosystems are emerging globally, aiming to address the needs of the underbanked and transition economies from cash to digital payments.

Financial inclusion remains a crucial goal in this milieu, particularly in Africa, where many individuals are underbanked. This means they may have bank accounts but aren’t fully utilising the financial services available to them. To improve access, scaling digital financial services is critical to enabling and achieving economic and social development. With the help of these technological advancements, payment service providers can expand and improve their services while reducing costs.

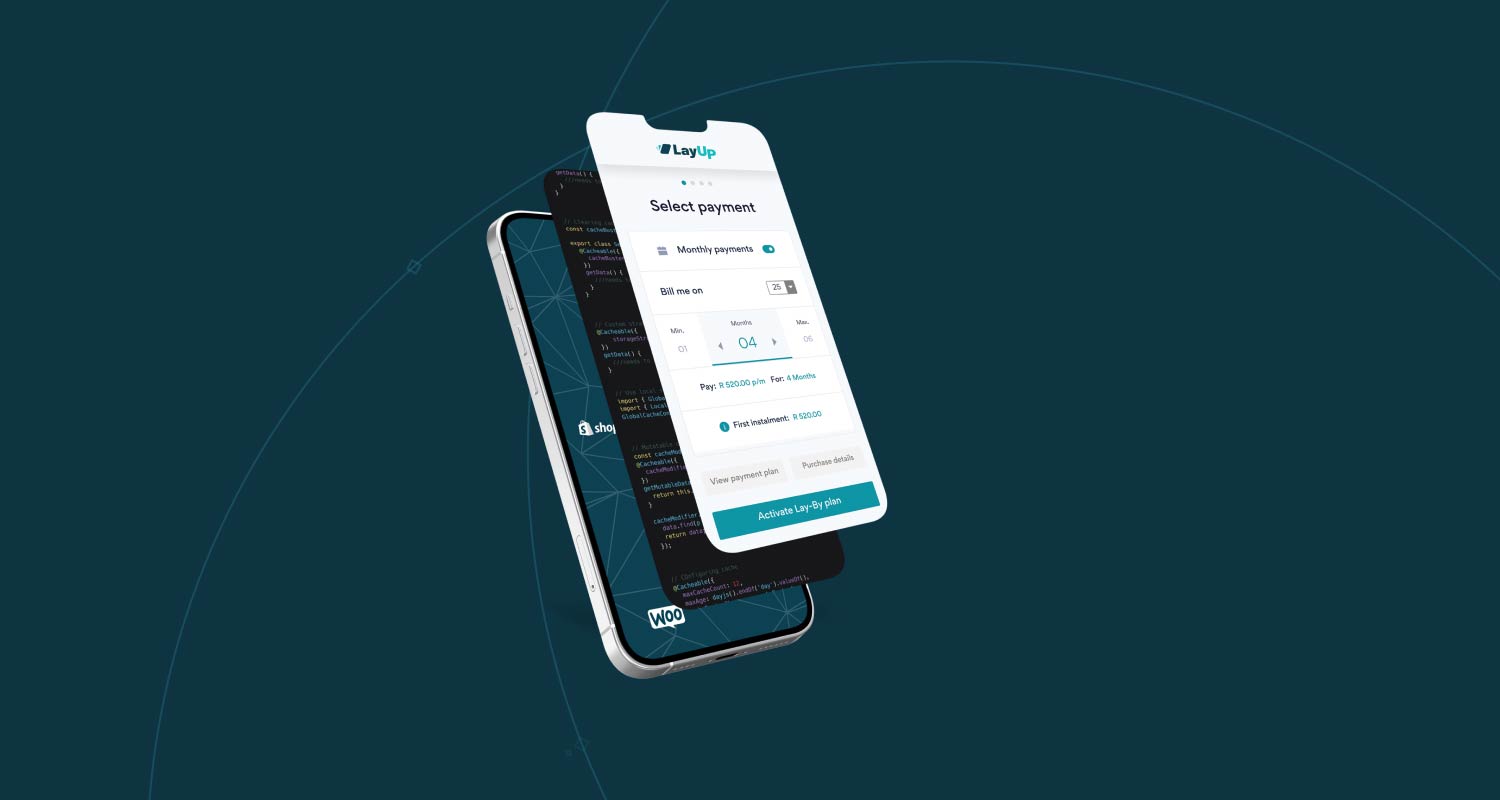

One notable transformation is the evolution of lay-by. LayUp Technologies is breathing new life into this age-old practice with its innovative cloud-based platform, automating the entire lay-by process from initial setup to reconciliation and collection. In this article, we’ll explore LayUp’s role in driving financial inclusion, allowing businesses to focus on what truly matters: growth and customer satisfaction.

Rise of digital payments

In today’s fast-paced and technology-driven world, the landscape of shopping and payment methods is constantly in flux. For businesses, processing payments more quickly and safely has become a top priority, which means investing in more digital payment solutions.

Technology enables merchants to establish an online presence, catalysing payment service providers to develop tailored online solutions. Small and medium enterprises require affordable solutions to accept digital payments, streamline them and boost incremental revenue. Traditional point-of-sale solutions are often too costly for these businesses. That’s why modern payment solutions offering value-added services can help SMEs manage their businesses more efficiently.

Fulfilling demand in a cash-heavy market

Despite 77% of South African adults having bank accounts, cash transactions still dominate, comprising over half of all consumer transactions. Recognising this certainty, LayUp’s lay-by offering redefines convenience for South African shoppers nationwide with its network of cash acceptance points. With a staggering 276 000 locations available for payments, customers can easily make their purchases and have them collected, reconciled and settled directly to the merchant. This widespread accessibility ensures that customers have numerous options to manage and make payments conveniently without travelling further to the store, making the process seamless and hassle-free.

Partnering with notable brands such as PnP Clothing, iStore, Cellucity, Dial-a-Bed and Zorora Sofas, both e-commerce and brick-and-mortar stores, LayUp offers customers financial flexibility and convenience while allowing businesses to boost incremental revenue and average order value by up to 25%. Whether looking to buy electronics, fashion items or household goods, customers who prefer spreading out their payments without incurring high-interest fees find value in using LayUp’s lay-by solutions.

Lay-by: LayUp’s comprehensive solution for retailers

Lay-by: LayUp’s comprehensive solution for retailers

Imagine a world where chasing payments and managing lay-by agreements are a thing of the past. Consider it done. LayUp is at the forefront of advancing lay-by payments in South Africa by providing a comprehensive solution that simplifies and automates the process. Here’s how the company is doing it:

1. Harnessing variable recurring payments

At the core of LayUp’s offering is its variable recurring payments (VRPs), which automate payment collection, ensuring timely and accurate transactions without manual intervention. This system minimises errors and maximises efficiency, making lay-by services more accessible and manageable for retailers.

Similarly, LayUp offers plugins that integrate seamlessly with existing e-commerce platforms, allowing retailers to provide lay-by options at checkout directly on their websites. Customers can select the lay-by option at checkout, set up their payment plans, and track their progress within the familiar online store environment.

In addition to online solutions, LayUp supports in-store lay-by offerings by integrating with POS systems. This allows retailers to provide flexible payment options at the time of purchase, enhancing the in-store shopping experience and facilitating larger purchases without immediate financial strain.

2. Effective communication and brand messaging

LayUp ensures consistent communication with customers throughout the lay-by process through automated notifications and updates. This transparency builds trust and reinforces the retailer’s brand message, encouraging repeat business and customer loyalty. Additionally, customers can manage and make payments away from the store.

3. Leveraging technology for efficiency

LayUp’s cloud-based platform is secure, scalable and accessible. What’s more, advanced analytics and reporting tools offer valuable insights into customer behaviour and sales trends, helping retailers make informed decisions to drive growth and access real-time data.

LayUp is reforming lay-by payments in Africa by offering a streamlined, automated solution that benefits retailers and customers. By leveraging technology and innovative payment systems, LayUp is making it easier for businesses to manage lay-by agreements and for consumers to access flexible payment options in a fast-changing retail environment. This advancement in lay-by payments contributes to greater financial inclusion and economic growth across the continent.

Join LayUp in transforming the future of retail in Africa and experience the benefits of a modernised lay-by system.

LayUp Technologies empowers both online and in-store businesses with cutting-edge recurring payment technology. Partnering with LayUp opens avenues to scale your business through innovative payment methods, driving market growth and boosting sales.

Originally published on TechCentral.